THANK YOU FOR SUBSCRIBING

Top Technologies in Energy and Utilities in 2017

Melvin Leong, Associate Director, Energy & Environment, Frost & Sullivan

Melvin Leong, Associate Director, Energy & Environment, Frost & Sullivan

The future of energy and utilities will focus on several key technology innovations that will boost industry operational efficiency and possibly change business models and competitive landscape. For example, advancements in waste heat recovery, enhanced oil recovery, and integrated gasification combined cycle (IGCC) are already driving development opportunities at various levels for modern energy providers and utilities.

Borderless innovation would mean that industry participants need to understand and embrace the augmentation of distributed energy generation, microgrid, lithium battery, battery energy management system (BEMS), and fuel cells.

Market Value

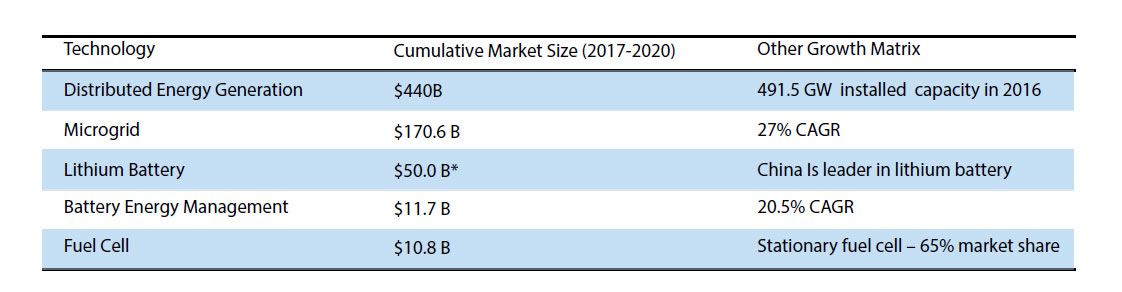

Frost & Sullivan forecast the following technologies’ cumulative market size over the period of 2017 to 2020.

Exhibit 1: Cumulative Market Size of Top Technologies for Energy and Utilities, 2017-2020

Distributed Energy Generation

Distributed energy generation is currently dominated by distributed solar, diesel generator set (genset) and micro combined heat and power (CHP) units. By 2019, distributed solar will become the most dominant distributed energy generation solution given that the deployment of solar and storage-based microgrids in developing countries.

Asia-Pacific will reap most benefits from the distributed energy resources in the next five years. China is leading in the adoption of distributed energy followed by Japan, South Korea, and India. The estimated revenue from distributed solar energy in China alone was approximately $21.5 billion in 2016.

In addition, adoption of predictive analysis-based platforms is already underway to meet the peak load demands and minimize energy crunch. Globally, full fledge adoption of predictive analysis is likely post-2020.

Advancements in waste heat recovery, enhanced oil recovery, and integrated gasification combined cycle (IGCC) are already driving development opportunities

Microgrid

Microgrids are currently an important distributed generation solution that connects renewable energy with remote locations without central power infrastructure. Additionally, solutions like energy management platforms and control solutions will play a major role in microgrid efficiency. Developing and under-developed countries in the regions like Africa and South-East Asia have the best potential to adopt renewable-sources-based microgrids for electrification.

Similar to distributed energy, Asia-Pacific is expected to become a leading region in the microgrid market in the next five years. Patent filing in microgrid from China and North America has grown from 2013 to 2016 at 1.36 percent and 1.21 percent respectively.

Lithium Battery

In 2017, a few start-ups are expected to commercialize silicon composite anodes. The silicon anode battery market is expected to account $833.8 million in revenue by 2025, with North America as the largest market. By 2019, solid-state batteries will find its way into more industry segments such as healthcare and defence.

Cathode with 2,000 Ah/kg capacity is likely to materialize commercially by 2023. This innovation will strengthen the position of lithium-ion batteries in the energy storage ecosystem for electric vehicles due to its cathode performance that ensures 2,000 charging cycles.

Battery Energy Management

BEMS has become increasingly important especially for high capacity battery either for electric vehicle or power grids. This technology is dominated by APAC-based entities in both patents and funding. 2017 is witnessing the rise of wireless BEMS mainly from start-ups with the aim to simplify the battery pack components and enable high flexibility configuration of battery pack in applications, especially electric vehicles.

By 2021, phase change materials may be introduced to address thermal management issues of a battery such as narrow optimum temperature range and operation efficiency in varying climates. In addition, the current price for BEMS is about $35/kWh. The price for BEMS is expected to reduce to about $30/kWh by 2023 due to advancements in Nanoscale Security Invented to Curb Hacking and circuitry.

Fuel Cell

Fuel cell technology is not new, and there was no significant breakthrough in innovation in 2016. Nonetheless, 2017 to 2018 is expected to be a resurgence period for fuel cell due to the high drive from major automakers.

Japan and South Korea is a huge market whereby stationary fuel cell is mainly deployed in the residential CHP segment. Due to fuel cell’s cost competitiveness, Japan is aiming to install 1.4 million units of residential fuel cells by 2020. On the other hand, automotive fuel cells are likely to cost $30/kW by 2023. Nanotechnology, such as nano-materials, will play a vital role in fuel cell improvement in terms of durability, reliability, and cost reduction.

Weekly Brief

I agree We use cookies on this website to enhance your user experience. By clicking any link on this page you are giving your consent for us to set cookies. More info

Read Also